Everything You Need to Know About Commercial Auto Liability Insurance

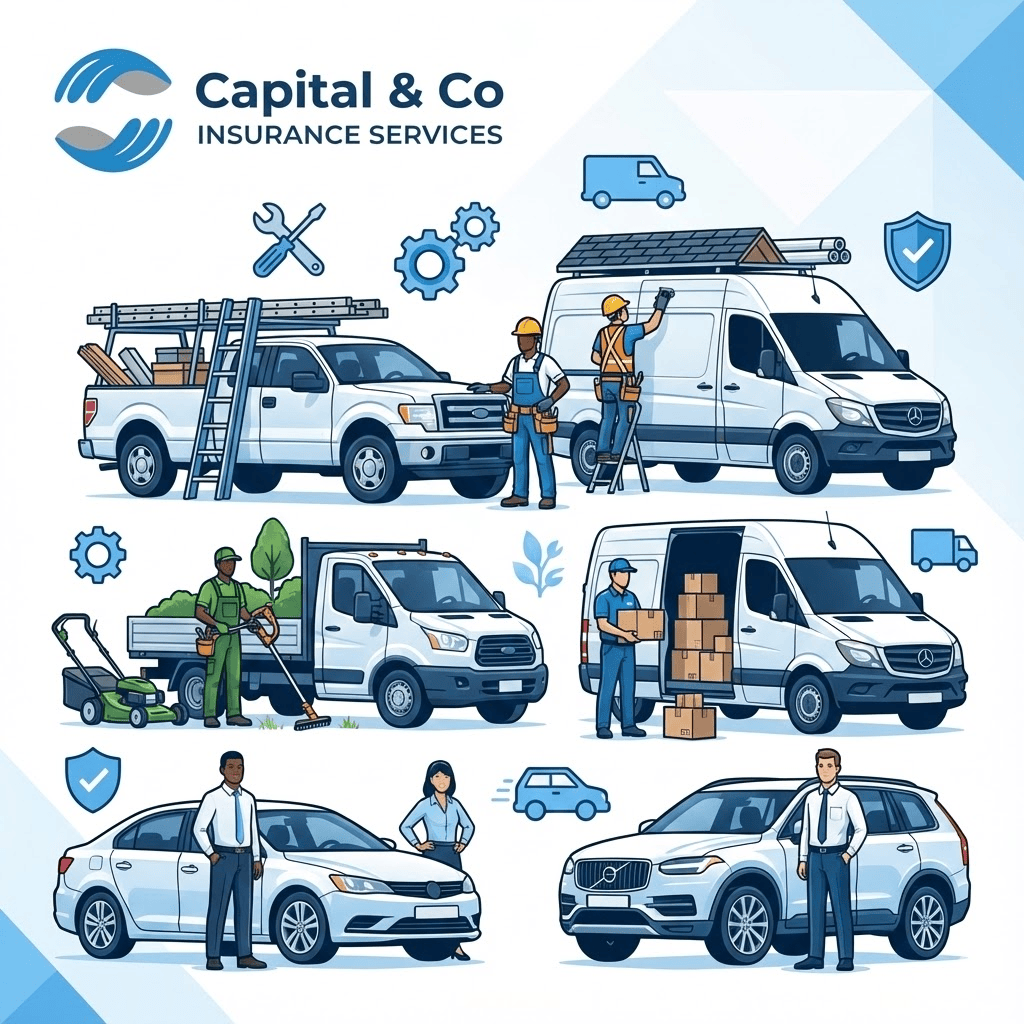

If your business relies on vehicles to get the job done—whether you’re a general contractor hauling tools to a job site, a plumber visiting clients, or a delivery service dropping off packages—your personal car insurance policy likely isn’t enough.

Accidents happen, and when they involve a business vehicle, the financial stakes are much higher. That is where commercial auto liability insurance comes in.

At Capital & Co Insurance Services, we specialize in helping contractors and small businesses in California, Oregon, and Washington find affordable, customized coverage. In this guide, we’ll break down exactly what commercial auto liability insurance is, why you need it, and how it protects your livelihood.

What Is Commercial Auto Liability Insurance?

It typically covers two main areas:

Bodily Injury Liability: Pays for medical expenses, lost wages, and legal fees if you injure someone else in an accident.

Property Damage Liability: Pays for repairs or replacement of the other person’s vehicle or property (like a fence or building) that you damaged.

Important Note: Liability insurance covers others. It does not cover damage to your own vehicle. For that, you would need to add physical damage coverage (collision and comprehensive) to your policy.

Who Needs Commercial Auto Insurance?

A common misconception is that only big trucking companies need commercial insurance. In reality, if you use a vehicle for work tasks beyond just commuting, you likely need a commercial policy.

You should consider this coverage if:

You transport tools or equipment: Carpenters, roofers, and landscapers often carry expensive gear that requires specialized coverage.

Employees drive your vehicles: If your crew drives company trucks to job sites, you are liable for their driving.

You deliver goods or people: Delivery drivers and courier services have higher risk exposures that personal policies exclude.

The vehicle is titled to the business: If the registration is in the company name, a personal policy generally won’t cover it

What Is Commercial Auto Liability Insurance?

Commercial Auto Liability Insurance covers your business if a company-owned or company-used vehicle causes:

Bodily injury to another person

Property damage to another vehicle or structure

Medical bills, legal expenses, or settlements

Court defense costs related to the accident

In simple terms:

👉 It protects your business from financial loss when your vehicle is at fault in an accident.